Traditionally, there are many ways to measure the future impact of an individual investment. Most businesses measure them using proforma financial statements. The challenge is the future part … how can we predict it with any accuracy? That’s where Monte Carlo financial modelling becomes your secret superpower.

If Monte Carlo reminds you of gambling, there’s a good reason for that. The method was code named after the Monte Carlo casino in Monaco. It was first experimented with by the mathematician Enrico Fermi in the 1930s. It wasn’t until the mid 1940s that it was officially named while being used on top-secret nuclear weapons projects in the United States.

It wasn’t used for financial forecasts for decades. It took a Harvard Business Review article in 1979 to popularise Monte Carlo in the world of corporate finance. It has since been used to analyse the potential future return of investments ranging from stock market options to startups.

The problem that Monte Carlo was designed to solve is simple sounding: How can we accurately predict the future state of something uncertain? If we all had access to a crystal ball, the answer would also be simple. Unfortunately, no such crystal ball exists. As a result, the only way for us to be accurate about a future uncertain event is to express it as a distinct range with a probability of the future event occurring within that range. What we’re talking about here is not which day of the week Christmas Day will fall on next year. Instead, it’s much less predictable events like what the chances are that the next hurricane in the gulf of Mexico will hit New Orleans five days after it has been officially identified. Expressing the outcome in terms a Monte Carlo simulation might produce, we may discover that there is a 40% chance that a hurricane will make landfall anywhere between 100 kilometers east and 65 kilometers west of New Orleans five days after it was identified in the Gulf of Mexico. That is a very accurate statement.

Think about the last time you created or read a business case. For those in corporate venture capital, think about the last time you read a pitch. For anyone who doesn’t fall into one of those categories, We are sure you’ll be able to play along regardless. We are willing to bet that your business case or pitch had a spreadsheet calculation that forecasted revenue and/or profit at least 5 years into the future. We are also willing to bet that it expressed that revenue or profit in 5 years as a single number with a plus or minus range on it, for example, year 5 profit at $150,000 +/- 50%.

On closer inspection, that prediction is actually a guarantee. It states, with certainty, that year 5 profit will be between $75,000 and $225,000. In interpreting the range, we also tend to consider, or even state, the number between the high and low bounds of the range as the most likely outcome.

How safe is that range and how likely is it for the predicted middle number to occur? Let’s consider these questions separately.

The range is computed using a single percentage that is intended to represent the maximum uncertainty of the outcome. That level of uncertainty is a critical input because we use the top and bottom of the range it produces as the worst and best case outcomes. Thinking about your last business case or investor pitch, how much effort and analysis did you put into deciding your +/- percentage? If you’re like most, the percentage was either mandated or you guessed. That calls into question the value of the range in deciding the best and worst case.

Now let’s examine the middle number of the range. Does it really represent the most likely occurrence? That depends on how the number was derived. If you, again, are like most, you would have taken educated guesses at the most likely outcome of each of the variables in the formula you are trying to calculate at some point in the future. Usually in some kind of proforma financial statement. This combination of educated guesses then accumulates into the outcome of your formula. The result is an educated guess derived from a number of other educated guesses. Is this accumulation of educated guesses that accurate? Not really. There is risk associated with each guess that is not accurately reflected. Some guesses will be more accurate. Some will be less so.

This raises another weakness of the +/- range approach common to most business cases … we have no way of asking how likely it is for the outcome to fall into any other range besides the absolute best and worst case. What if we want to know the range that is 75% likely to occur? We cannot answer this question. If you are tempted to answer by using a +/- of 75%, that will only return the absolute best and worst case in a range that is guaranteed to be between 2 numbers that are 150% apart from one another.

Great. Now we know the method we’ve been using for years is flawed. What can we do to make it better? Monte Carlo, of course!

Monte Carlo is a method that uses statistics and computational brute force to produce a range of outcomes and an associated probability that the actual outcome falls within that range, like the hurricane example above. The way it works is it asks for a maximum and a minimum for each variable in the formula you are forecasting at some point in the future. It then randomly selects a number in the max to min range of every variable and computes the value of the formula. Then, it takes thousands of those randomly selected variables within their ranges, computing the formula each time. For example, say that the formula to forecast has only 2 variables: “profit = x + y”. Let’s say that “x” ranges from 1 to 3 and “y” from 1 to 2. If our Monte Carlo could only select whole, non-decimal numbers, it would calculate the possible outcomes as:

Profit = 1 + 1 = 2

Profit = 1 + 2 = 3

Profit = 1 + 3 = 4

Profit = 2 + 1 = 3

Profit = 2 + 2 = 4

Profit = 2 + 3 = 5

Therefore the range of possible outcomes for profit is $2 to $5. Because we asked for the absolute max and min of each variable, the probability that we express for the true value to be contained in this range is 100%. In other words, we have forecasted that there is a 100% chance that profit will be between $2 and $5.

Most scenarios are not as simple. In the case of a profit formula, each variable has much more variation. That variation can be modelled using a probability distribution called the normal distribution. It’s the bell curve that we all fell victim to in college at some point. We can use the normal distribution for every variable because of something called the Central Limit Theorem. An explanation of why that is true is within the scope of a statistics textbook. As long as we have some data for each variable (technically, a sample size of 30 or more data points), the Central Limit Theorem applies and we can use Monte Carlo with the normal distribution. Note that if a variable in your formula is obviously not normally distributed, the appropriate distribution should be used. For example, if a variable can only be true or false, the binomial distribution should be used. If you are in doubt at all, use the normal distribution.

Monte Carlo then uses the ranges provided for each uncertain variable and the normal distribution to select a random number in each range to compute thousands of different scenarios for a formula. Because each variable was selected with the normal distribution, the output looks like the bell curve described above. We can then slice and dice that curve into ranges with associated probabilities, as described above.

Now that the technicalities are out of the way, phew!, let’s explore what Monte Carlo can do that your typical proforma business case cannot.

The main power of a Monte Carlo analysis is in its ability to slice and dice ranges of outcomes with associated probabilities. Using the profit in year 5 of a startup’s business model as an example, we could answer any number of questions including:

- what profit range is 99% likely to occur?

- how likely is it that profit will be between $200,000 and $600,000?

- how likely is it that profit will be above zero?

Returning to the ranges for each uncertain variable in your formula, there is an interesting side effect to explore. Say we have one variable that has a fairly tight range where the best case is 50% higher than the worst case and another variable that has a best case that is 500% higher than the worst case. Which variable could use more analysis and more data? The one with the wider range, of course. Using Monte Carlo analysis, we reveal the areas of the formula we are analysing that require more data and experimentation. It provides another view on where the riskiest assumptions are in a business model. It also allows for simple, and very robust, what-if analysis across all variables in a formula at the same time. Contrast that with the ability to alter only 2 variables at a time in a traditional financial sensitivity analysis.

Another exciting possibility provided by the discrete ranges of each variable in a formula is the ability to calibrate estimation of those ranges. Humans are not particularly good at estimating future uncertain events. We typically estimate ranges that are too narrow as we chronically assume we know more than we do.

This systematic overconfidence is especially dangerous when we attempt to estimate with precision as we are asked to do in a traditional business case. Research has not only shown this overconfidence but also that better estimation is possible through calibration.

What kind of calibration? Let’s try it ourselves. Imagine the Eiffel Tower. What range, from absolute tallest to absolute shortest, is 100% certain to contain the true height of the Eiffel Tower in meters? Try it now.

Thinking about the problem in 2 parts can be helpful. In other words, what height is impossible for the Eiffel Tower to be taller than? Could you make that height shorter and have it remain impossible for the Eiffel Tower to be taller than it? If so, reduce the height and ask that question again until you can’t reduce the maximum height further. Repeat that process in reverse with the minimum height (ie. what height is impossible for the Eiffel Tower to be taller than?) and you have as accurate a range as you can get. If you tried that on your own you can find the actual height of the Eiffel Tower here to see if your range was accurate.

We can perform the same hack when it comes to Monte Carlo ranges for a business model formula. What we should NOT do to construct ranges is guess what each variable is likely to be and add a +/- buffer to it to absorb error. While this feels safe, the initial guess anchors the range we derive artificially. By splitting the range into the 2 discrete questions of max and min, we avoid the many human biases that creep into our decision making when we try to guess a point value accurately. This creates a more accurate range for Monte Carlo to act on. When it does, it smooths out any errors in our ranges by, as explained above, running thousands of permutations and combinations of values in the ranges for each uncertain variable in a formula. This frees us from needing to be precisely accurate with a point estimate, which is not what we humans are good at.

Let’s return to our original need for a method like Monte Carlo. It is to measure the impact of an individual investment. Just like a proforma business case, we need to know the formula for the impact we are trying to understand. That formula can typically be derived directly from the startup’s business model and their sales funnel. Let’s take a new bank credit card as an example. Say that we are deciding if we will launch the card in a particular national market. We will only do it if we can sell 5,000 credit cards in a month. What do we know about the sales funnel for a credit card? Say we know that:

- People will see our ads for the credit card and decide if they want to visit the information webpage about it

- Of those people, some will request more information about the card

- Of those people, some will submit an application for the card

- Some of those people will like the card so much that they will buy another credit card from the same bank and might even recommend others to visit the website for the credit card

What we’ve just described is a standard funnel that is described by something coined by venture capitalist Dave McClure called Pirate Metrics.

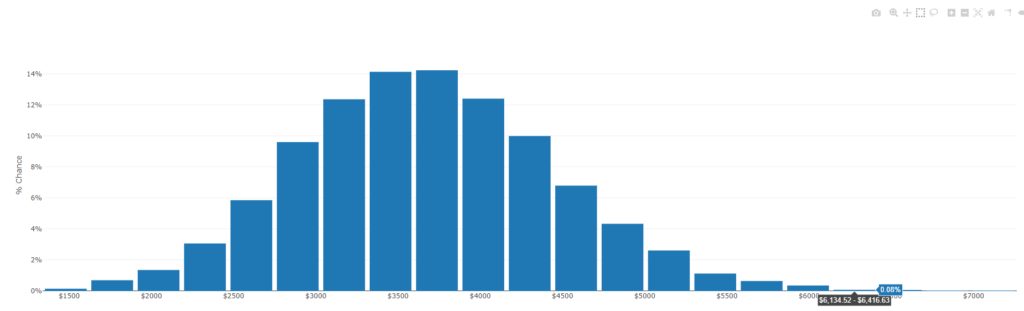

We can now take the elements of our funnel and express them in a mathematical formula for profit. Once we establish ranges for each uncertain variable in our formula, we can apply Monte Carlo and get an output that looks something like this:

No matter how you slice and dice this, it is the picture of accuracy for your formula.

As you can see this way of approaching estimations has clear benefits over traditional methods. Furthermore, this approach is very much connected to a product’s development roadmap. Using Monte Carlo to create estimations helps product teams prioritize investments in different parts of their business model based on different potential outcomes. It can also help determine the fail conditions of an experiment by starting from a desired outcome.

Whether your team is early stage or at a more mature point in the evolution of your product, Monte Carlo is a vastly superior crystal ball compared to traditional methods of financial forecasting.